Investing your money can be one of the most important decisions you make in life. With so many different types of investments available, it is important to understand which ones are best suited to your individual financial goals. This article will provide an overview of the various types of investments, including abroad investment.

Domestic Investments: Domestic investments are those investments made within your home country. They include stocks, bonds, mutual funds, and real estate. When investing domestically, you are generally subject to the regulations and laws of your home country. Domestic investments tend to be more secure than investments abroad, as they are less vulnerable to exchange rate fluctuations, political instability, and other external factors.

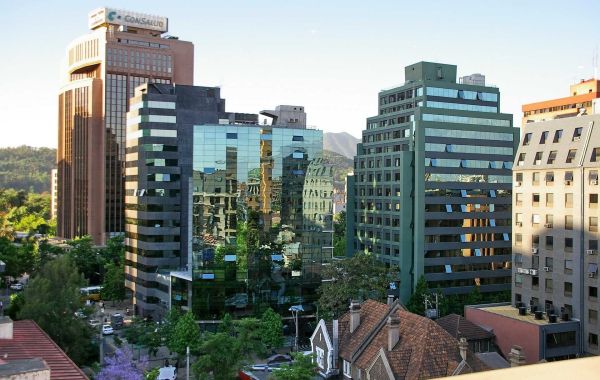

Abroad Investment: Abroad investments involve investing in foreign markets. This can be done through mutual funds, stocks, bonds, and other investment vehicles. Investing abroad carries more risk than domestic investments, as there is no guarantee of performance. Additionally, exchange rate fluctuations and political instability in the target country can have a significant impact on returns. Despite this, abroad investments can be extremely rewarding and offer diversification benefits not available in domestic investments.

Commodities: Commodities are physical items that can be bought and sold. Popular commodities include gold, silver, oil, coffee, and grains. When investing in commodities, you can buy them directly or through a broker. Commodities are typically more volatile than other investments and can be subject to political and economic events.

Real Estate: Real estate investments involve buying and selling property. This can include residential real estate, such as single-family homes, condos, and apartment buildings, as well as commercial real estate, such as office buildings, shopping centers, and warehouses. Real estate investments are generally considered to be long-term investments, as they tend to appreciate in value over time.

Alternative Investments: Alternative investments include investments that are not typically considered mainstream, such as art, collectibles, and private equity. Alternative investments can be highly speculative and may not be suitable for most investors.

More about abroad investment

With the uncertainties of the world economy, more people are turning to investing abroad to diversify their portfolios and maximize their returns. Investing abroad can be a great way to access new markets and capitalize on different opportunities, but it also carries its own set of risks. Before you take the plunge, it’s important to understand the benefits and risks associated with investing abroad.

Benefits of Investing Abroad

One of the biggest advantages of investing abroad is the potential for higher returns. Foreign markets can often be less mature and volatile than domestic markets, providing investors with opportunities to make more money. Investing in foreign markets with Global Citizen can also help to diversify your portfolio, reducing your risk and allowing you to benefit when one market is doing well and the other is not.

In addition, foreign markets often have different regulations and regulatory structures than domestic markets, giving investors the opportunity to take advantage of different investment opportunities. This can include different types of investments, such as commodities or foreign currency, or different strategies, such as investing in emerging markets.

Finally, investing abroad can give you access to different currencies, allowing you to benefit from currency fluctuations. This can be especially beneficial for investors looking to diversify their portfolios, as different currencies can provide different levels of return.

Risks of Investing Abroad

Of course, investing abroad also carries its own risks. Investing in foreign markets can be more volatile, and there is always the risk that you could suffer losses if the markets don’t perform as expected. In addition, foreign markets are subject to different regulations and legal systems, which can make it difficult to protect your investments.

Finally, foreign currencies can also be volatile, meaning that your investments could be affected by currency fluctuations. This is why it’s important to understand the risks associated with different currencies before investing.

Conclusion

Investing abroad can be a great way to access new markets and capitalize on different opportunities, but it also carries its own set of risks. Before you take the plunge, it’s important to understand the benefits and risks associated with investing abroad, as well as the different currencies and regulations in different countries. With the right knowledge and strategy, investing abroad can be a great way to diversify your portfolio and maximize your returns.