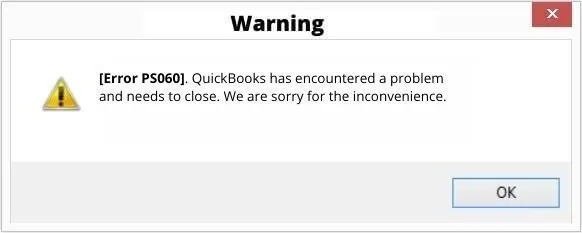

In this article, we will guide you step by step on how to fix QuickBooks payroll Error PS060 and get back to business smoothly.

Error PS060 is a common issue that many QuickBooks users face, and it can be frustrating when it prevents you from processing payroll for your employees. But fear not, with our expert tips and troubleshooting techniques, you'll be able to resolve this error and get your payroll running seamlessly.

The Error PS060 in QuickBooks Payroll can occur due to a variety of reasons. It could be due to an issue with your QuickBooks Payroll subscription, a problem with your company file, or even a conflict with a third-party application installed on your system. Understanding the root cause of the error is crucial for effectively resolving it.

Steps to troubleshoot QuickBooks Payroll Error PS060

Whether you're a small business owner or an accountant, our solutions are tailored to help you efficiently resolve this issue. We understand that time is of the essence, so we'll provide you with concise yet comprehensive instructions to quickly get you back on track.

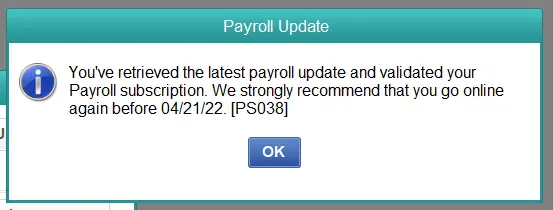

The first step in troubleshooting QuickBooks Payroll Error PS060 is to check for any pending updates for your QuickBooks software. Outdated software can sometimes lead to compatibility issues, which can trigger this error. Make sure to update your QuickBooks to the latest version and see if that resolves the issue.

Next, you'll need to verify the status of your QuickBooks Payroll subscription. Ensure that your subscription is active and that you have the necessary permissions to access the payroll features. If there's an issue with your subscription, you may need to contact QuickBooks support to resolve it.

Resolving any issues with the company file

Another common cause of QuickBooks Payroll Error PS060 is a problem with the company file. The company file is the backbone of your QuickBooks data, and any corruption or damage to this file can lead to various errors, including the PS060 error.

To address any issues with the company file, start by running a QuickBooks Verify and Rebuild Data tool. This tool will check for any inconsistencies or errors in your company file and attempt to fix them. If the issue persists, you may need to create a new company file and transfer your data to it.

It's also important to ensure that your company file is stored in a secure location and that you have regular backups. This will help you avoid data loss and make it easier to restore your company file in the event of a problem.

Checking for conflicts with third-party applications

Sometimes, QuickBooks Payroll Error PS060 can be caused by a conflict with a third-party application installed on your system. These applications, such as antivirus software or other accounting tools, can interfere with the proper functioning of QuickBooks Payroll.

To identify and resolve any third-party application conflicts, start by temporarily disabling any antivirus or firewall software that may be running on your system. Then, check for any other accounting or payroll-related applications that may be installed and try uninstalling them.

If the issue persists, you may need to perform a clean reinstallation of QuickBooks Payroll. This will ensure that any underlying issues with the software are addressed and that it is installed correctly on your system.

Reinstalling QuickBooks Payroll

If the previous troubleshooting steps haven't resolved the QuickBooks Payroll Error PS060 or QuickBooks Error PS038, it may be necessary to reinstall the software. This can help address any underlying issues with the installation or configuration of QuickBooks Payroll.

To reinstall QuickBooks Payroll, start by uninstalling the current version of the software. Be sure to follow the proper uninstallation process to ensure that all components are removed from your system. Once the uninstallation is complete, download the latest version of QuickBooks Payroll from the official Intuit website and install it on your system.

During the reinstallation process, be sure to carefully follow the on-screen instructions and ensure that you have all the necessary information, such as your QuickBooks Payroll subscription details, company file, and employee data, readily available. This will help ensure a smooth and successful reinstallation.

Seeking professional assistance for QuickBooks Payroll Error PS060

If you've tried all the troubleshooting steps and the QuickBooks Payroll Error PS060 persists, it may be time to seek professional assistance. The QuickBooks Payroll support team can provide you with more specialized guidance and help you identify the root cause of the issue.

When contacting QuickBooks support, be prepared to provide them with detailed information about the error, including any error messages, the steps you've taken to troubleshoot the issue, and any relevant information about your QuickBooks Payroll setup. This will help the support team quickly identify the problem and provide you with the appropriate solutions.

In some cases, the issue may be more complex and may require the assistance of a QuickBooks-certified professional, such as an accountant or a bookkeeper. These experts have in-depth knowledge of QuickBooks and can often provide more comprehensive solutions to resolve complex payroll-related issues.

You may also read:- QuickBooks error 1603 when updating

Final Tips

By following the steps outlined in this article, you should be able to successfully resolve the QuickBooks Payroll Error PS060 and get your payroll processing back on track. Remember, addressing the root cause of the issue is key to ensuring a long-term solution.

To avoid encountering the QuickBooks Payroll Error PS060 in the future, it's important to keep your QuickBooks software up-to-date, maintain a healthy company file, and be vigilant about any third-party applications that may be interfering with your payroll processing.

Remember, QuickBooks Payroll Error PS060 is a common issue, but with the right troubleshooting steps and professional assistance, you can resolve it and ensure that your payroll processing runs smoothly.