Coach JV @powerofpublish0

* 46 CRYPTO LAWSUITS.

* BITCOIN ETFS DELAYED FOR YEARS.

* INNOVATION STIFLED BY ENDLESS ENFORCEMENT.

Is this a coincidence?

Or was there a coordinated campaign to kill crypto before it killed the status quo?

Because when money moves freely—political control weakens.

And that terrified the establishment.

Gensler brought a record 46 enforcement actions in 2023.

Coinbase. Kraken. Ripple. No rules—just lawsuits.

Meanwhile, the rest of the world embraced crypto.

The U.S. punished it.

Elizabeth Warren called crypto a “threat to national security.”

Maxine Waters said FIT21 was “a wish list of Big Crypto.”

NY AG Letitia James proposed the toughest crypto crackdown in the country.

Were all Democrats anti-crypto?

No.

71 supported FIT21.

76 backed repealing the DeFi Broker Rule.

But the loudest, most powerful voices?

Firmly against.

Billions in lost investment.

Founders fleeing offshore.

Years of regulatory uncertainty.

Then in 2024—after dragging their feet....

The SEC finally approved spot Bitcoin ETFs… and tried to take a victory lap.

The truth?

Crypto is freedom.

It strips power from centralized institutions.

It gives individuals control.

And that’s exactly why it was roadblocked.

So yes—there is a correlation.

This isn’t left vs. right.

It’s freedom vs. fear.

And for years, fear won.

But not anymore.

Wake Up ?

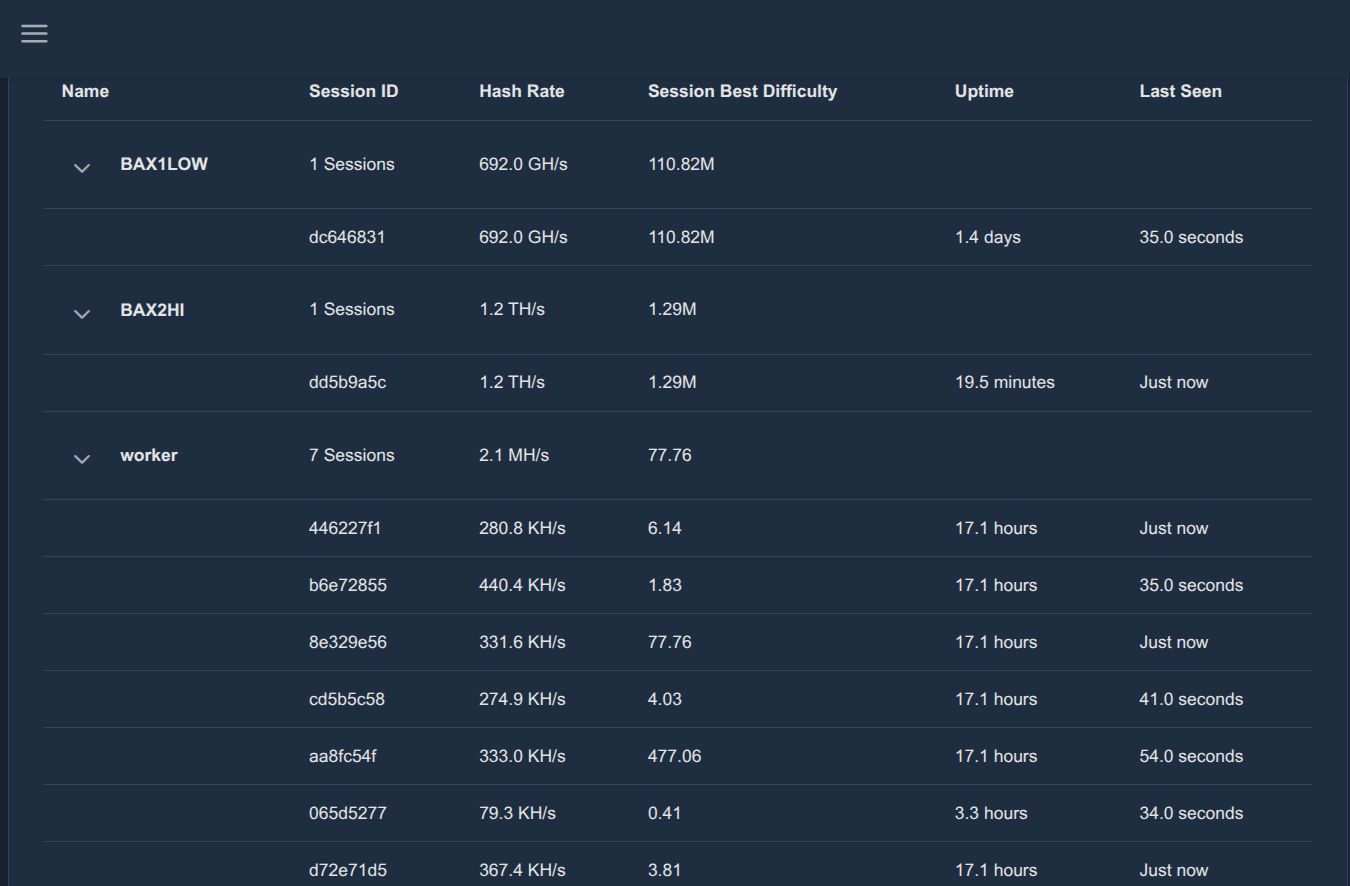

Happy New Year Kryptids ! 2025 was mostly a buying year for me, prices were low for much of it, so DCA-ing in was the game. My investments are spread across 18 different cryptos, with pricing from 0.000001 to 100,000 (thats just the investment portfolio), I hold numerous other coins that are not an active part of the portfolio, but if any one of them decides to moon, well, lets just say I am not sentimental, its cashin time.

From what I hear, 2026 will be the year of utility tokens, so take that any way you want. I hear that in 2024 also, and NFT's became the thing. One never knows where the crypto winds blow.

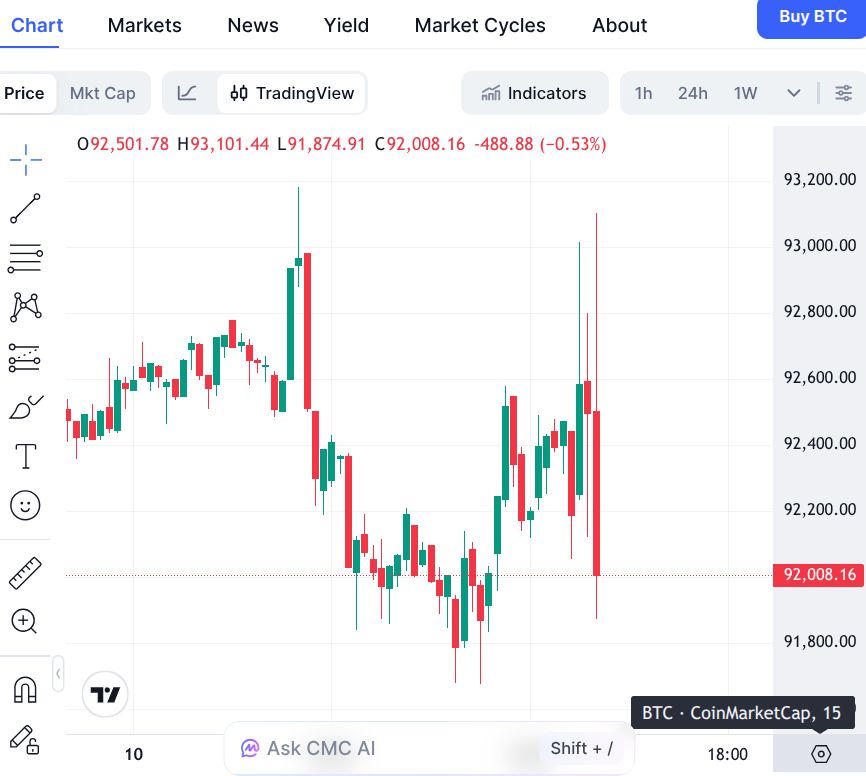

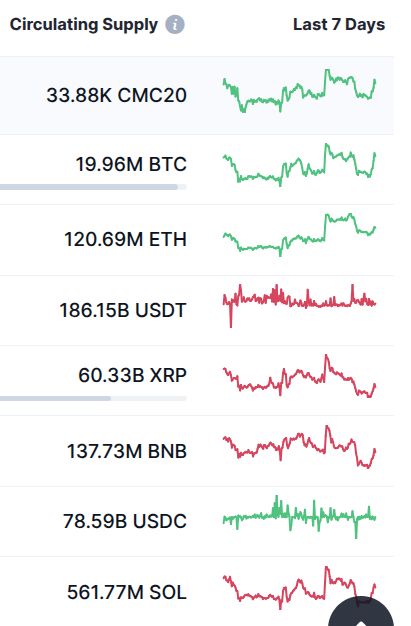

The CMC20 is just a clone of Bitcoin, so why purchase any? Just get the real thing. If BTC doubles, CMC20 doubles, big deal, nothing gained. Notice the others do not show the same pattern, so CMC20 is very heavily weighted to BTC.

One minute after 2pm and BTC spiked to 93200, but then retreated within the next minute.