Freelancing offers flexibility and independence, but it also comes with financial challenges, especially when tracking income and managing payroll. Unlike traditional employees, freelancers do not receive formal pay stubs, making it difficult to provide proof of income for tax purposes, loans, or rental applications. This is where a paycheck creator free tool becomes essential. It helps freelancers generate accurate pay stubs, track earnings, and maintain financial records effortlessly.

The Importance of Accurate Earnings Tracking for Freelancers

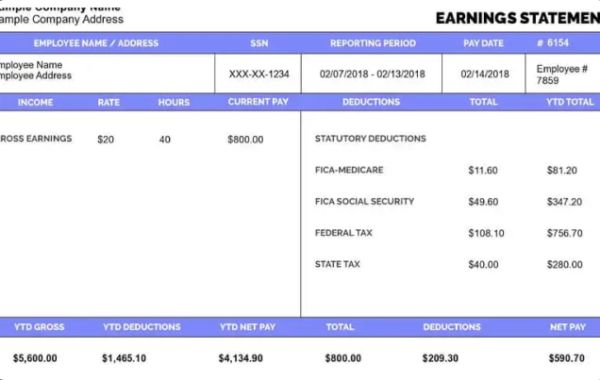

Freelancers work on multiple projects for different clients, often with varying pay rates and payment schedules. Keeping track of all these payments manually can be overwhelming. A paycheck creator free tool simplifies this process by automatically calculating earnings, deductions, and net pay, ensuring accuracy and consistency.

Why Freelancers Struggle with Payroll Management

Irregular Income – Unlike salaried employees, freelancers get paid per project, making income tracking complex.

Lack of Pay Stubs – Many clients pay via direct deposit or online platforms, but they do not provide detailed pay stubs.

Tax Obligations – Freelancers are responsible for their taxes, requiring them to maintain detailed financial records.

Proof of Income Challenges – Applying for loans, renting a home, or securing business financing requires income verification.

How a Paycheck Creator Free Can Help Freelancers

A paycheck creator free tool provides freelancers with a structured and professional way to document earnings. Here’s how it benefits them:

1. Generates Professional Pay Stubs

Many freelancers struggle to prove their income when applying for credit or housing. A paycheck creator free tool generates pay stubs that look professional, helping freelancers establish financial credibility.

2. Tracks Income Efficiently

Instead of manually tracking invoices and payments, a paycheck creator organizes income details in one place, making it easier to manage finances.

3. Simplifies Tax Preparation

Tax season can be stressful for freelancers, but with a paycheck creator, they can easily track earnings and deductions, ensuring accurate tax filings.

4. Saves Time and Reduces Errors

Manually calculating income, taxes, and deductions increases the risk of mistakes. A paycheck creator automates these calculations, ensuring accuracy.

5. Provides Clear Financial Documentation

Freelancers often need to show proof of income for various reasons, including applying for mortgages or business loans. Pay stubs from a paycheck creator serve as official financial documents.

Features of a Good Paycheck Creator Free Tool

A reliable paycheck creator free tool should offer:

Automatic Income Calculation – Computes gross and net pay, including deductions.

Customizable Templates – Allows freelancers to add personal details and payment information.

Downloadable and Printable Pay Stubs – Provides PDF versions for record-keeping and submission.

No Hidden Fees – Offers completely free access without extra charges.

Secure Data Storage – Ensures personal and financial information is protected.

How to Use a Paycheck Creator Free as a Freelancer

Using a paycheck creator free tool is simple. Follow these steps:

Enter Personal Information – Input your name, business name (if applicable), and address.

Add Payment Details – Enter income amount, payment frequency, and deductions.

Generate Pay Stub – The tool calculates gross and net pay automatically.

Download and Save – Keep copies for tax filing and income verification.

Conclusion

A paycheck creator-free tool is a must-have for freelancers who need an easy and professional way to track their income, prepare for taxes, and provide proof of earnings.

Start using a paycheck creator free today and take control of your freelance earnings!

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?