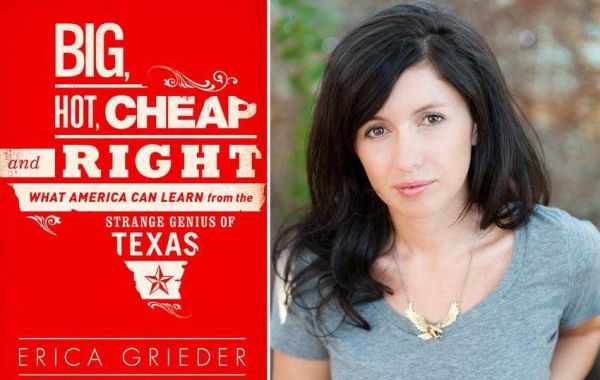

The book was originally published by Public Affairs in 2013 (iii). Erica Grieder is a San Antonio native and senior editor in Texas Monthly. She is an incisive observer of the state’s political and economic affairs. She also worked as a correspondent for The Economist and her writing has been published in New York Times, Atlantic, Spectator, and New Republic. Thus, she is well-informed and experienced enough to write on the topic. In her book, Grieder evaluates the praise and critique of Texas provided by experts and media and asserts that the rest of the country should learn from what the state has done. This interview essay format paper provides the review of the above-mentioned book.

I agree with the author’s argument that the State of Texas should not be underestimated because of its rapid success by individuals who argue that its economic achievements come exclusively from its oil resources. The author starts by discussing what she calls the ‘Texas Miracle’ and then demonstrates that various factors have facilitated the success of the state (Grieder 1). During and after the recession, unlike other states, Texas had the ability to provide jobs (Grieder 13-16). Besides, the state’s economy remained relatively strong and stable. Grieder asserts that the housing lending laws of Texas were considerably harsher than those of most other states in the union (Grieder 19). Since the problem of housing market was one of the major causes of the recession, Texas housing laws minimized the effects of the recession because they provided better consumer protection (Grieder 20). The author considers housing lending laws as one of the reasons why the state’s economy remained stable during and after the recession. The success of the state should, therefore, not only be attributed to its rich oil reserves.

Some individuals claim that Texas had the ability to provide more jobs during and after the recession because it had large oil supplies (Grieder 16). However, Grieder debunks these assertions by arguing that during that time, the population of Texas was increasing (18). Furthermore, a large portion of jobs created was not within the oil industry (Grieder 21). Most jobs were white-collar (Grieder 18). Grieder’s compelling point is that Texas’ oil economy did not negate the economic problems experienced all over the country. As a result, the jobs available in Texas were not less or more valuable than jobs in other states. It shows that the State of Texas worked with what it had, and thus, its oil reserves were not the main reason for the state’s economy to remain strong during and after the recession. The book points out that Texas has been working on ways to diversify its economy since the 1980s (Grieder 22). This approach helped the state to remain economically stable in difficult periods. For this reason, the success of Texas should not be exclusively attributed to the oil industry.

The state’s low taxes also played a significant role in ensuring that its economy remained stable (Grieder 25-26). Low taxes are friendly for business (Grieder 27). The author asserts that the taxes collected were invested in improving the social welfare of people. The economic stability of Texas did not depend on taxes (Grieder 30). The state’s industries were successful and strong enough to support the economy. It reduced the effects of the recession on the state’s economy.

Grieder encourages to implement the Texas model in other states. The author points out that Rick Perry’s government made Texas a business-friendly state (Grieder 14). The state’s economic success can be largely attributed to the business-friendly environment created by Perry’s government. Perry elaborated policies that discouraged corruption and boosted industries (Grieder 29). I support the author’s argument that these factors are essential for the economic and social success of Texas. Social welfare is very significant in any society. The use of taxes to improve the welfare and happiness of Texas citizens was prudent. Besides, low taxes encouraged businesses and created job opportunities for the people of Texas. As Fields (2016) explains, low taxes encourage businesses to invest more money into society (133).

As I was reading the book, I disagreed with some of the author’s arguments and practices carried out by the government. The book points out that the government sought out viable industries, offered them grants, and acted protectively towards them. On the one hand, such an approach created a capitalistic system. On the other hand, it prevented the growth of energy alternatives that are environmentally friendly because the government promoted and protected the oil industry against the competition. Economic stability and success should not only benefit the economy but also improve health and overall wellness and happiness of people (Radcliff 95). Thus, the government should encourage and promote the development of clean energy alternatives, such as wind and solar power which are more beneficial for the environment. Instead of the Texas government looking at these alternatives as competition for the oil industry, it should have encouraged their growth, created more jobs, and improved not only the economy but also the environment and health of people.

Grieder explains that Texas strives to promote and safeguard Texas business in accordance with the elaborated model (18). This model is employed exclusively in Texas. However, I do not support such an isolationist perspective. Texas is the only “red” state that pays more taxes to the federal government than it receives as benefits. It would be more beneficial to the economy of the United States if the state of Texas allowed and encouraged other states to copy its model. If other states could adopt the Texas model, the United States would minimize its dependence on oil import. Other states would harness environmentally-friendly and renewable energy sources, such as solar and wind power, like Texas had done (Grieder 34). Irrespective of how huge the state’s oil resources were, Texas could not rely on oil only. Wind and solar energy industries created jobs for the people of Texas and helped the economy of Texas remain stable during and after the recession. If the Texas model was adopted by other states, it would benefit the environment and improve the economy. Thus, the Texas model should not be employed exclusively by Texas.

I agree with the author that America can learn from the strange genius of Texas, especially when handling problems related to the economy and social life of people. As Grieder discusses the policies in Texas’ sanctuary cities, she points out that law enforcement officers in these cities do not question the immigration status of individuals unless there exists a direct reason to do so (216). This approach results in minimal discrimination. She adds that the state’s government as well as government-paid agencies, such as police departments, does not have adequate resources, and thus, does not want to do more than it has to (Grieder 216). For this reason, police departments do not want to use their insufficient resources to arrest, detain, and deport individuals unless it is absolutely necessary (Grieder 216). It shows that Texas runs in an economically conservative way. On the other hand, Grieder describes Texans as open-minded individuals. This aspect makes the Texas model different from those of other states and that of the federal government. This model helps the Texas government to efficiently solve its social and economic problems.

Idisagree with Greider’s argument that focusing on business is the solution to discrimination and corporate exploitation. She asserts that the Texas government does not try to solve every little problem and thus, problems related to corporation discrimination and exploitation should be solved by focusing on promotion and support of independent and small businesses. However, it is the responsibility of the Texas government to ensure that every Texan is given an opportunity to succeed due to equalizing social programs and to reduce the impact of social discrimination and oppression (Hernon et al. 172).

I also dislike the author’s argument that it does not matter if politicians in Texas are crazy or corrupt since the people of Texas are very pragmatic and concentrate on what is pragmatic (Grieder 67). I disagree with the statement because ignoring irresponsible practices at the local, state or federal levels leads society to exploitation and social problems. Consequently, such arguments should not be used to describe the strange genius of Texas and should not be adopted by other states.

All in all, this paper has reviewed Erica Grieder’s book Big, Hot, Cheap, and Right: What America Can Learn from the Strange Genius of Texas. I agree with the author that low taxes and the ability of Texas to provide jobs during and after the recession helped its economy remain strong and stable. On the other hand, I disagree with the government’s practices of supporting some industries and sabotaging others.