How are mobile payment applications arranged?

Major global brands have long had their own mobile applications, which not only make it convenient to view and select products, create a shopping cart, but also make instant payments. The TouchCard online service provides a merchant (legal entity) with the opportunity to conduct any payment transactions quickly, safely and reliably. The development of a payment application for your business is a new level of financial relations with a client.

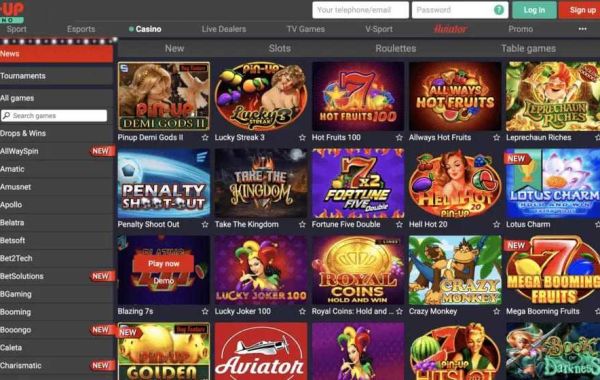

The software solution for making payments https://devoxsoftware.com/blog/payment-app-development-process-challenges-and-cost/ makes it possible to make payments remotely from a desktop computer or terminal. Developing a mobile application for iOS and Android devices opens up a wide potential for promoting your business. Now your customers, while on the road, on vacation, or in any other place, using the application, not only learn about your company, but also make purchases and pay for them in the same application.

Functionality of the payment application for iOS and Android devices:

Sending notifications. The application receives messages about discounts, promotions, current offers and other news;

Formation of a single basket of goods or services for purchase or payment;

Feedback for the client (message, call, geolocation of the company);

A quick order or booking of services allows you to establish direct interaction with the client and avoid abandoned carts;

Updating customer data, quick feedback to resolve issues;

Quick formation of a photo gallery, content, links to a YouTube channel;

Saving time and comfort for the client when ordering services or buying goods;

Statistics service. Saving the history of payment transactions, purchases, orders, clicks;

Round-the-clock communication with content, support, payments;

Original design, combination of functions in one application;

Templates for bank cards. The client does not need to manually enter data each time;

The integration of mobile applications contributes to the development of your business, increase in customers and, most importantly, the convenience of making payments for goods or services on the Internet if you have a smartphone.

What are the advantages of mobile payment applications for entrepreneurs and their customers?

Development of mobile applications for business is a popular service aimed at minimizing efforts and reducing time when making payments on the Internet. Previously, to pay for goods, it was necessary to find a payment terminal or go to the company's website, look for payment details on the website of the online store. The mobile application combines all the advantages of an online store and a bank.

Highlight the main advantages of payment applications for iOS and Android

High security standards PCI DSS and PA-DSS ensure the safety of customer personal data and bank card information;

Real-time payment tracking. The application has built-in intelligent control that allows you to identify and reject suspicious transactions;

Making a payment in 2-3 clicks. After entering the bank card details for the first time, you no longer need to repeat this every time you make a transaction;

Using multiple bank cards. Before making a payment, you only need to select the card that will be used to pay for the purchase of goods or services;

Minimum Commission

With the development of digital technologies, it is important to stay on the wave and promote your business in the key of the latest payment instruments. Are you planning to launch payment mobile applications for running your business or developing an online store? On the site touchcard.com.ua it is convenient to order a mobile payment application based on the concept of direct interaction using multi-touch gestures.