Dealing with debt collectors can be stressful, but it's essential to know your rights and when you have grounds to take legal action against harassment. In this blog, we'll explore the circumstances under which you can sue debt collectors for harassment, empowering you to protect yourself from unfair practices.

The Fair Debt Collection Practices Act is a federal law designed to protect consumers from abusive and unfair practices by debt collectors. Under the FDCPA, debt collectors are prohibited from engaging in certain behaviors that could be deemed as harassment.

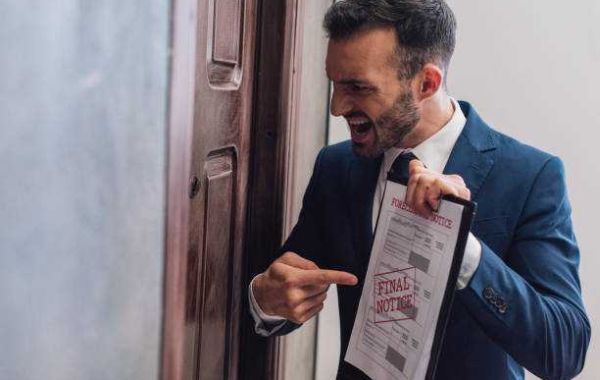

If debt collectors are bombarding you with calls at inconvenient times or repeatedly calling you with the intent to annoy, abuse, or harass, you may have grounds for legal action.

Debt collectors are not allowed to use threats, intimidation, or abusive language when attempting to collect a debt. If you have experienced such behavior, it may be a violation of the FDCPA.

Debt collectors must provide accurate information about the debt and their intentions. If they make false representations, such as misrepresenting the amount owed or threatening actions they cannot legally take, it could be a basis for legal action.

Debt collectors are restricted in their communication with third parties. If they disclose information about your debt to friends, family, or employers without your consent, it may be a violation of the FDCPA.

Once you dispute a debt in writing, debt collectors must cease collection attempts until they provide you with verification of the debt. If they continue to pursue collection without providing verification, you may have a case for harassment.

Unfair practices, such as adding unauthorized fees or charges to the debt, can be grounds for legal action. Debt collectors must adhere to ethical and legal standards in their collection efforts.

Document all interactions with debt collectors, including dates, times, and the nature of the communication. This record will serve as crucial evidence if you decide to take legal action.

Inform debt collectors in writing that you prefer all communication to be in writing. This can help create a paper trail and reduce the risk of harassment over the phone.

If you believe the debt is not valid or if there are inaccuracies, dispute it in writing. Debt collectors must provide verification of the debt, and failure to do so can strengthen your case.

Before taking legal action, consult with an attorney experienced in consumer protection laws (https://techduffer.com/when-can-i-sue-debt-collectors-for-harassment/). They can provide guidance on the specifics of your situation and advise you on the best course of action.

If you believe you have a valid case for harassment under the FDCPA, you can file a lawsuit against the debt collectors. Consult with your attorney to determine the appropriate jurisdiction and gather the necessary documentation to support your case.

Knowing your rights under the Fair Debt Collection Practices Act is crucial when dealing with debt collectors. If you experience harassment in violation of the FDCPA, you may have legal grounds to sue. Take proactive steps to protect yourself, keep thorough records, and seek legal advice to determine the best course of action. Remember, you have the right to be treated fairly and without harassment during the debt collection process.