Moreover, month-to-month loans might help enhance a borrower's credit rating when repayments are made persistently and on time.

Moreover, month-to-month loans might help enhance a borrower's credit rating when repayments are made persistently and on time. A solid credit historical past opens doorways to raised rates of interest and mortgage terms sooner or later, additional enhancing the borrower’s financial hea

Next, research numerous lenders and their offerings. Focus on rates of interest, compensation periods, and any additional charges that might apply. Always read the fantastic print to know the total scope of the mortgage phrases. Consider on-line platforms that aggregate loan details for easily evaluating prese

Moreover, the fast approval processes often mean less scrutiny, potentially leading to expensive borrowing choices. It is significant to completely grasp the loan phrases, including fees and penalties, before continuing. Navigating these disadvantages is essential to ensuring that borrowing remains a positive step towards monetary rel

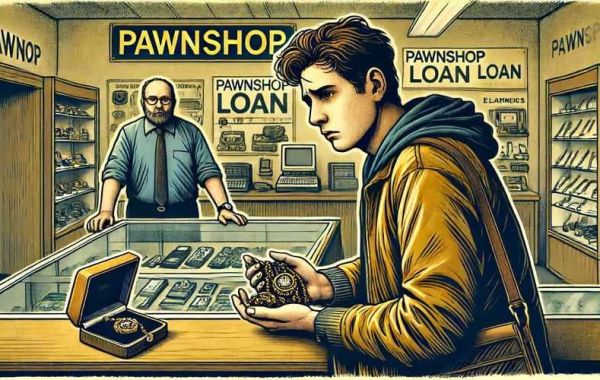

BePick: Your Go-To Resource BePick is a devoted platform that gives extensive info and evaluations about pawnshop loans. It serves as a useful useful resource for individuals considering this borrowing choice or looking to learn more in regards to the intricacies of pawning gadgets. The web site presents detailed guides, skilled insights, and firsthand critiques, empowering customers with the information necessary to make informed selecti

Another option is payday loans, designed for people who want cash quickly. However, they often include very high-interest rates and fees, making them a much less favorable alternative. Credit card cash advances also can serve as emergency funding, though rates of interest for cash advances are generally greater than for normal purcha

Additionally, it’s critical to review any charges related to the mortgage, such as origination fees or prepayment penalties, which may considerably have an result on the entire cost over the lengthy run. Borrowers ought to search out clear and clear loan agreements to keep away from any hidden co

Additionally, the short loan terms can be difficult for individuals who need extra time to collect funds. If the

Monthly Payment Loan just isn't repaid throughout the specified time frame, the borrower risks shedding their pledged merchandise complet

It's also essential to note that not all items maintain vital resale value. Pawnshops often offer a fraction of an item's price, that means individuals would possibly depart with less money than anticipated. This can lead to disappointments if the mortgage amount doesn't cover quick monetary ne

What Are Employee Loans?

Employee loans are financial developments extended by an employer to an worker. Typically, these loans are deducted instantly from the worker's paycheck, permitting them to repay the amount over time with out incurring high-interest rates often related to conventional loans. The main objective of worker loans is to offer employees with quick access to funds for unexpected bills whereas making certain they remain financially sec

BePick: Your Go-To Resource for Employee Loans

BePick is a devoted platform that provides comprehensive data and user evaluations related to worker loans. Understanding the intricacies of these loans can be overwhelming, however BePick provides priceless insights that make it easier for individuals and corporations to make knowledgeable selecti

Another key benefit is the absence of a credit verify. Many individuals, particularly

relevant webpage those facing monetary difficulties, may be apprehensive about making use of for loans due to their credit score historical past. Pawnshop loans permit them to bypass this barrier, making these loans an invaluable resource throughout emergenc

Employee loans may be price it, especially for people dealing with financial emergencies or those who might wrestle to obtain loans by way of traditional methods. They often include decrease rates of interest and simpler software processes. However, it's crucial to judge personal monetary circumstances and ensure reimbursement phrases are managea

Pawnshop loans can be a practical monetary resolution for those in want of quick money. Utilizing personal possessions as collateral, this feature permits individuals to safe funds with out in depth credit score checks or lengthy approval processes. For many, pawnshops offer an efficient approach to handle short-term monetary challenges, making it an important topic to explore. In this article, we will delve into the intricacies of pawnshop loans, their advantages and downsides, and the important elements that borrowers want to contemplate. Additionally, we'll introduce BePick, an informative platform dedicated to offering insights and evaluations on pawnshop loans, equipping individuals with the information they n

Considerations Before Applying

While emergency loans could be helpful, it’s vital to rigorously consider the implications of taking one out. **High-interest rates** and costs can result in a cycle of debt, making it necessary to assess whether or not you can comfortably repay the mortg

How To Love Yourself As A Senior Bbw

Door Christopher Miller

How To Love Yourself As A Senior Bbw

Door Christopher Miller Jobs That Are Perfect for People Who Like to Work With Their Hands

Door Kevin Gardner

Jobs That Are Perfect for People Who Like to Work With Their Hands

Door Kevin Gardner Best canadian pharmaceuticals online

Door Rosa Smith

Best canadian pharmaceuticals online

Door Rosa Smith What is the greatest online casino in Canada?

What is the greatest online casino in Canada?

Mentioned previously in despatches

Door SEO Consultant

Mentioned previously in despatches

Door SEO Consultant