How to Use the Cash Envelope System to Create a Budget and Save Money | #financial

How to Use the Cash Envelope System to Create a Budget and Save Money | #save

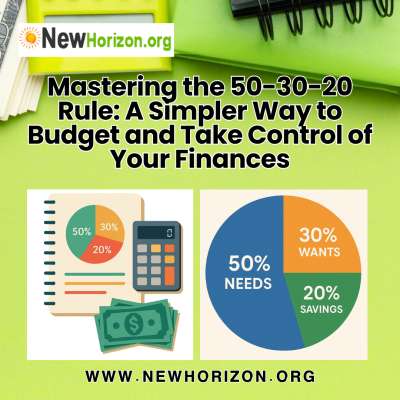

Discover how to manage your money with the simple and effective 50-30-20 budgeting method. Learn to divide your income into needs, wants, and savings to improve financial health, reduce debt, and build long-term wealth. Perfect for beginners and experienced budgeters alike.

Discover a simple and effective way to take control of your finances with the Cash Envelope System. This beginner-friendly method helps you stick to a budget, track your spending, and boost your savings using physical cash and envelopes. Learn how to set up your system, avoid overspending, and stay motivated with expert tips and tools like budget binders.

Whether you're trying to get out of debt or just want to manage money better, this guide has everything you need. Read the full article here: How to Use the Cash Envelope System to Create a Budget and Save Money

Understanding what's the difference between a freeze and an alert is crucial for making informed decisions about securing your credit. A fraud alert warns creditors to verify your identity before opening any new accounts, whereas a credit freeze blocks all access to your credit report, What's the difference between a freeze and an alert? While both options help guard your credit making it harder for fraudsters to open accounts in your name. You can read the full article here: https://www.newhorizon.org/cre....dit-info/secured-vs-

Bad credit? No problem! With New Horizon Business Service, you can get the credit card you need, regardless of your credit history. With our easy application process, you can be approved for a store credit card in no time. So what are you waiting for? Apply today!